With so much equity flowing freely these days, getting a home equity line of credit (HELOC) can be a great way to pay for home renovations, help pay for a child’s college tuition, or finance other important financial goals. Unlike a traditional mort

Jun 27, 2023 | Refinancing a Home

Home loans sponsored by the Department of Veteran Affairs, or VA loans, are an amazing resource for active duty military personnel. They offer low interest rates and do not require down payments. But what about if you have ended your military service? Can

Jun 22, 2023 | VA Loans

Have you always wanted to buy a second home in your favorite vacation spot, but you’re not sure if it makes financial sense to take on a second mortgage before paying off your first? It can be a tricky question as it feels like a trade-off between g

Jun 20, 2023 | Purchasing a Home

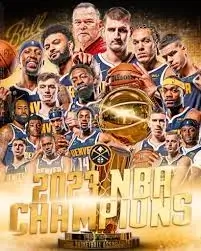

Congrats to our Denver Nuggets on becoming the 2023 NBA Champions Have a Great Celebration Today!

Jun 15, 2023 |

With the explosive home price growth of the last few years, many people have been priced out of the homebuying market. If you fall in this category, there may be some avenues you could still try to break into the homeownership scene. One of these is short

Jun 15, 2023 |

Mortgage interest rates have risen sharply in the past year, having bumped around the 3% -4% range for the last decade. After getting so accustomed to that range of rates, many borrowers are struggling with today’s level in the 6% span. However, his

Jun 13, 2023 | Interest Rates